How to Use Google Sheets to Manage Your Budget and Finances

In today's digital age, managing one's finances and budgeting has become more accessible with the use of online tools and software. Google Sheets, a free online spreadsheet program, is one such tool that can help individuals keep track of their income and expenses, plan their spending, and work towards their financial goals. With its ease of use, accessibility, and collaborative features, Google Sheets is an excellent option for those looking to manage their finances more effectively.

This guide will walk you through the basics of using Google Sheets for budgeting and financial management. We will cover the essential steps of setting up a budget, tracking income and expenses, and using formulas and functions to analyze your financial data. Whether you are new to budgeting or looking to streamline your existing process, using Google Sheets can help you gain control over your finances and make informed decisions about your money.

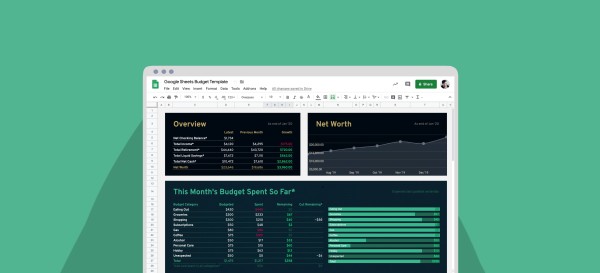

In the following sections, we will explore the various features and functions of Google Sheets and how they can be applied to financial management. We will cover everything from setting up a budget template to creating charts and graphs to visualize your financial data. By the end of this guide, you will have the knowledge and tools necessary to use Google Sheets for effective budgeting and financial management.

Setting Up a Budget Spreadsheet in Google Sheets

Creating a budget spreadsheet in Google Sheets can help you keep track of your income and expenses, and help you identify areas where you can save money. To start, create a new spreadsheet and define income and expense categories that you need to track. You can then set up formulas to calculate totals and balances. Customizing the appearance and layout of your spreadsheet can make it easier to use and visually appealing.

Entering and Tracking Income and Expenses in Google Sheets

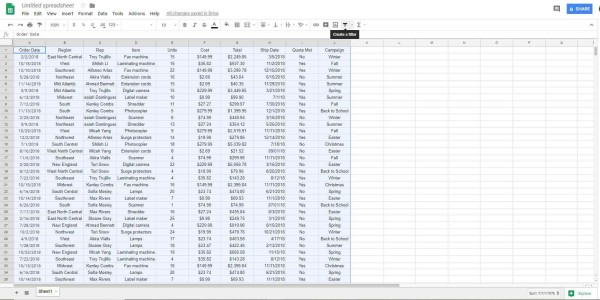

After setting up your budget spreadsheet, you can enter income and expense data. You can add or remove income and expense categories as needed. You can use autofill and copy/paste functions to streamline data entry. Regularly updating and reviewing the spreadsheet is crucial to track progress and adjust budgets as needed. You can also use different views of the data, like sorting or filtering by categories, to get a better understanding of your spending habits.

Advanced Techniques for Budget and Finance Management in Google Sheets

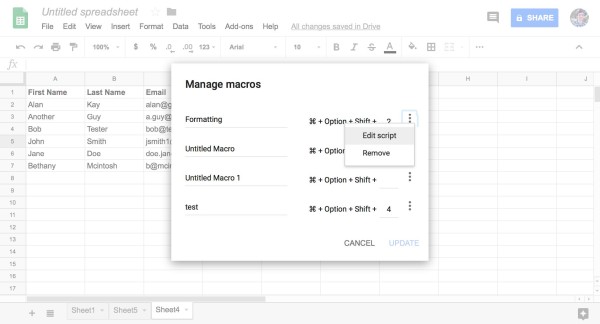

To further manage your budget and finances, you can use advanced techniques in Google Sheets. Conditional formatting can be used to highlight important data and trends, like exceeding a budget or saving more than expected. You can also create charts and graphs to visualize your budget data, which can help you quickly identify areas where you can improve. Using data validation and dropdown menus can simplify data entry and reduce the chances of errors. Lastly, you can collaborate with others on the same spreadsheet and control access to data to ensure the security of your financial information.

Conclusion

In conclusion, Google Sheets provides an excellent platform for managing personal budgets and finances. With its user-friendly interface and comprehensive suite of tools, it allows users to easily set up and customize budget spreadsheets, track expenses and income, and analyze financial data. By regularly updating and reviewing the spreadsheet, users can stay on top of their finances and make informed decisions about their spending habits.

While the basics of setting up a budget spreadsheet in Google Sheets are relatively straightforward, there are also advanced techniques that can help users further optimize their financial management. Conditional formatting, data validation, and collaboration tools all provide valuable ways to streamline data entry, simplify analysis, and share information with others. As technology continues to evolve and new features are added to Google Sheets, there will likely be even more opportunities for users to leverage the platform for financial management.

Overall, using Google Sheets to manage one's budget and finances can lead to greater financial stability and peace of mind. By taking advantage of the platform's many features and functions, users can gain greater insight into their spending habits and financial situation, and make informed decisions about their future financial goals.