Avoid Scammers with Identity Theft Protection

If you want to know what identity theft protection is and whether or not you need it, this article provides the answers you seek.

It is obvious knowledge that the internet, however helpful, is a den for all sorts of cybercrime including identity theft. This is why signing up for identity theft protection becomes important.

How Identity Theft Protection Services Work

Identity theft protection is a term used to describe any service that helps to safeguard your personal information such as your birth date, account details, social security number, and other details from thieves that want to use this information for unethical practices.

Identity theft protection services work by monitoring databases and websites to detect whether your personal information shows up on any suspicious site. It then notifies you if any of your personal information is compromised.

With identity theft protection, you’re able to prevent fraud on your identity before it happens and also fix the damage if it happens.

Types of Identity Theft Protection

There are four types of identity theft protection namely:

- 1.Identity monitoring

- 2.Credit monitoring

- 3.Identity theft insurance

- 4.Identity theft recovery

Identity Monitoring

Identity monitoring services help to search all databases for your personal information such as your name, address, email, etc. If any of your private information turns up somewhere suspicious, say on the dark web, for instance, you will be alerted.

It typically notifies you of any fraudulent activity that may be linked to your identity before it happens, giving you some time to take action. They also provide a list of possible solutions for issues of identity breach.

Credit Monitoring

Credit monitoring services are meant to prevent credit-related identity theft. They monitor credit reports, and even credit scores and notify you when any activity occurs.

Activities may include a change of address, new account opening, a loan application, and any other suspicious activity. If you receive an alert for an activity you didn’t authorize, it means identity theft is occurring.

Identity Theft Insurance

This offers insurance services in the event of identity theft. A victim of an identity theft who subscribed for identity theft insurance services will be reimbursed for any money they spend on recovering their identity and fixing credit reports.

Identity Theft Recovery

They offer identity recovery services to victims of identity theft. Victims can try to recover their identities by themselves but the process is usually strenuous and time-consuming. This is where identity theft recovery comes in.

They help you to handle all the work required to restore your identity, including contacting law enforcement, writing emails to creditors informing them that identity theft has taken place, and more.

Some Examples of Identity Theft Protection Services

Some of the best Identity theft protection services include:

- Identity Guard

- Life Lock by Norton

- Identity Force

- Privacy Guard

- ID Shield

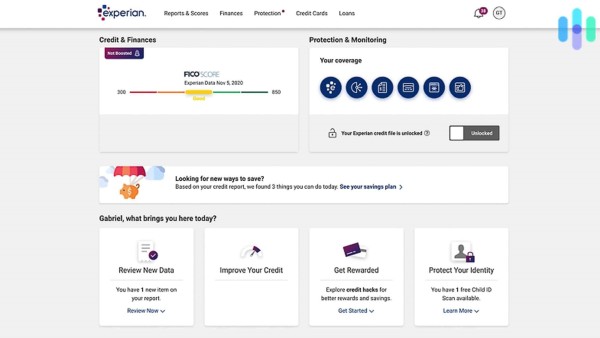

- Complete ID by Experian